Expat Health Cover for Families

Navigating international health insurance can feel like a maze. At Global Albatross, we make it simple.

We specialize exclusively in international medical insurance for expatriates. Unlike brokers who spread themselves thin across dozens of products, we go deep—mastering the policies, benefits, exclusions, and fine print so you don’t have to.

Got a question about your current plan? We’ll clear it up. Looking at new options? We’ll find what fits. Need to change your individual or group coverage? We’ve got the team to make it happen.

Ethical advice, world-class service, and a commitment to maximizing the value of your health insurance—that’s our promise.

Global Albatross. Discover the difference.

Which Cover Is Best For You?

Wherever you choose to live, the right medical insurance is essential to ensure fast, reliable access to care. In a life-threatening emergency, that could mean being evacuated home—or to a country with higher-quality treatment.

Medical standards vary widely from region to region, which is why it’s critical to have international insurance that travels with you—and meets the standards of each place you call home.

Every family is different. And with so many policies, complex terminology, and hidden exclusions, choosing the right plan can feel overwhelming. That’s where we come in. We help you make sense of the fine print, so you can make confident, informed choices.

Our Impartial Advice Depends on Several Factors

Intended country of residence

What you need and want to be covered for

Pre-existing medical conditions

Benefits vs price

Accompanying family members

Global Albatross ensures you get the right medical cover for your situation, needs and budget.

Policy Benefits

The core section of any policy is the in-patient benefit. This provides cover for serious illnesses and accidents as well as medically necessary surgeries which are normally high-cost and require a stay in hospital.

Out-patient benefits automatically include cover for in-patient treatment, but also include treatment that does not require hospitalisation.

In-patient (core)

- Private or semi-private rooms

- Inpatient surgeries – including surgeons’ and anaesthetists’ fees

- Intensive care

- Cancer treatment

- Transplant services and kidney dialysis

- Diagnostic procedures

- Advanced medical imaging (MRI, CT and PET scans)

- Organ transplants

- Renal failure and dialysis

- Specialist consultations

- Emergency dental

- Emergency evacuation – includes travel costs for an accompanying person, accommodation and compassionate visits

- Medical repatriation – includes repatriation of mortal remains

- Psychotherapy and psychiatric care

Out-patient

Includes in-patient benefits plus…

- Consultations with medical practitioners and specialists

- Out-patient surgeries

- Diagnostic tests

- Dental accidents

- Prescribed medication

- Maintenance of chronic conditions

- Physiotherapy and chiropractic treatment

- Osteopathy and acupuncture

- Podiatry and chiropody

- Chinese traditional medicine and homeopathy

- Dietician

- Psychotherapy and psychiatric treatment

- Speech therapy

- Therapeutic aids and appliances

Add-on benefits

- Maternity cover – Routine and complications of childbirth, 8-12 month wait-periods apply

- Dental care – Preventative, routine, major restorative, orthodontic treatment

- Health and wellness checks – physical exams, pap smears, mammograms, cancer screenings

- Vision – Spectacle lenses and frames, contact lenses and prescription sunglasses

- Accidental death and dismemberment

- Terminal illness cover

- Travel insurance

- Life insurance

- Income protection

- Child immunisations

- Travel vaccinations

Additional features

- Private or public hospital cover

- Cover for specific pre-existing conditions

- Easy claim processes, fast claim refunds and online claims tracking

- Family discounts

- No-claims discounts

- Direct billing – provided by some insurers and in some countries

- High-cost treatment pre-approval

- Lifetime renewable

- Optional 24-month moratorium or full medical underwriting (FMU)

- Medical advice help lines

- Money back guarantee periods

- Various payment methods and payment frequency options

- Smart phone apps

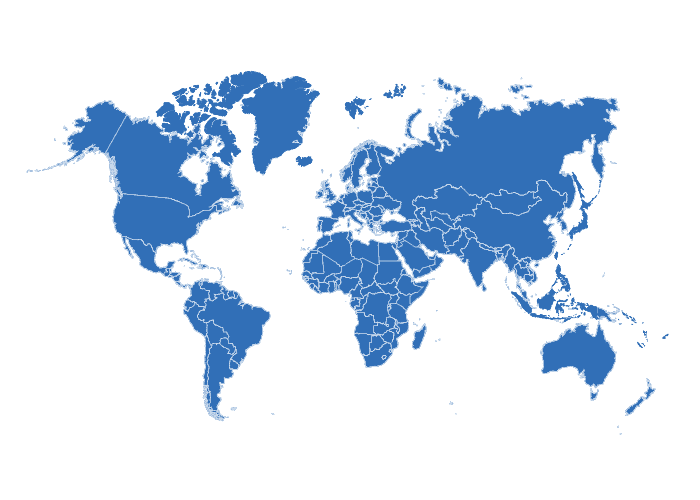

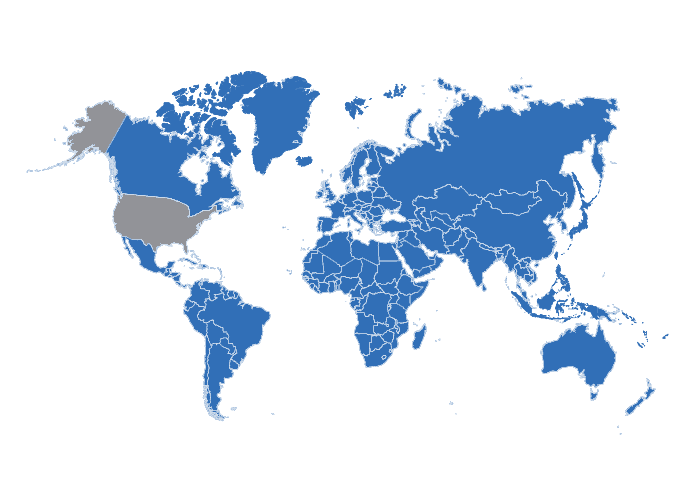

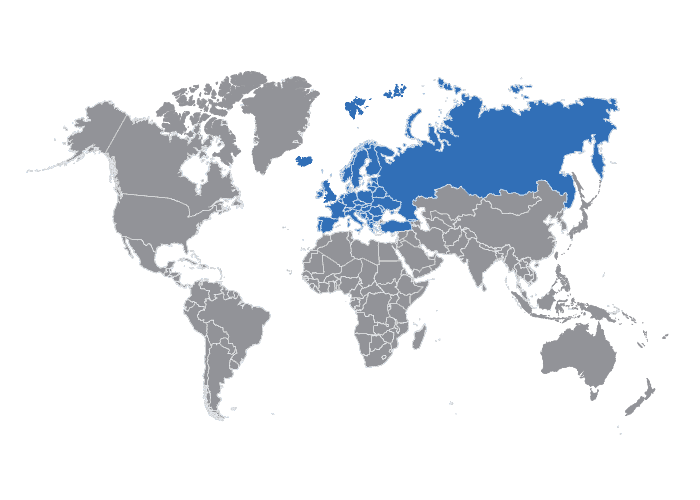

Areas of Cover

A number of areas of cover are available. However as an expatriate, a worldwide, excluding USA policy is important to consider. Worldwide cover ensures treatment of any illnesses or injuries, no matter where you are in the world, and also avoids the need for finding a new policy for each country or region that you relocate to.

WORLDWIDE

WORLDWIDE (excluding USA)

EUROPE

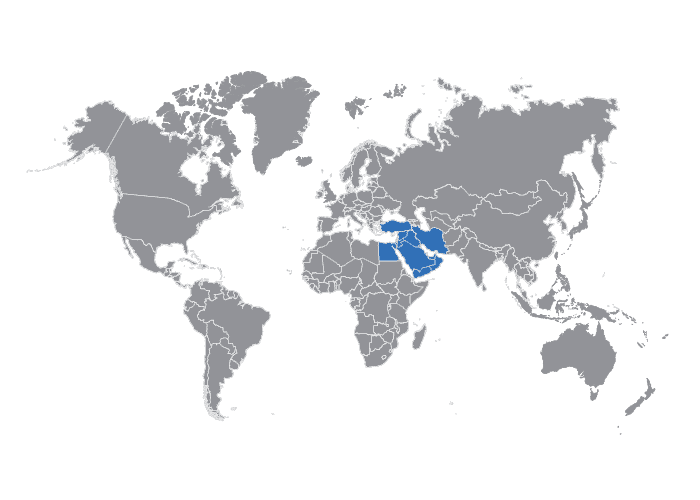

MIDDLE EAST

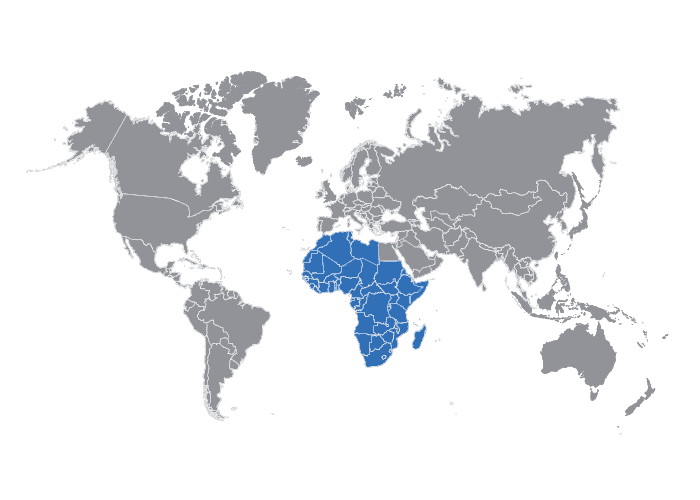

AFRICA

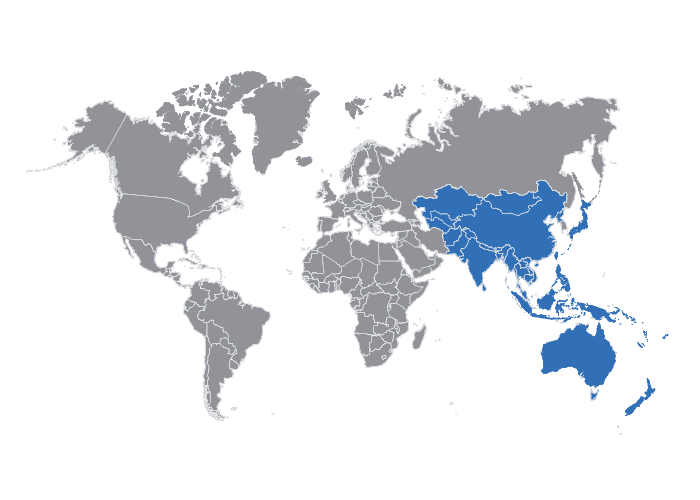

ASIA and the PACIFIC

Our 5-Step Process

1. Situation and needs analysis

We ask questions that are quick and easy to answer and help us determine the type of cover you need.

2. Compare options

Insurers are identified that are likely to best meet your requirements. Benefit and premium comparisons are provided.

3. Fine tune

Preferred plan options are fine-tuned. Policy benefits and premium are negotiated on your behalf, saving you time and money.

4. Policy selection

Options are discussed and recommendations provided. The application is managed to ensure it progresses as it should.

5. Implementation

Policy is arranged and documentation delivered. We hold insurers to account, arrange payment guarantees, advocate on your behalf with claims, and deliver medical emergency support.