Worldwide Health Insurance for Individuals

International health insurance is fundamentally different from local health insurance. Unlike local plans, international policies offer global coverage, higher annual limits, and access to both private and public medical facilities. They’re designed for people who live and work across borders—providing choice, flexibility, and peace of mind wherever life takes you.

These plans may appear similar at first glance, but they differ significantly in how benefits are structured, what exclusions apply, and how claims are processed. Understanding these nuances is critical when choosing the right policy.

One of the greatest advantages of international coverage is portability. As an individual, you can take your policy with you when moving to another country—avoiding the hassle and risk of switching between local policies that may exclude conditions developed along the way.

This continuity of cover is crucial. If a chronic illness or serious injury occurs, your international policy ensures ongoing access to treatment—no matter where you live—as long as you maintain the premium. It’s long-term protection that moves with you, safeguarding both your health and your lifestyle.

The Right Cover, Wherever Life Takes You

Having the right health insurance is essential to ensure immediate access to medical care—no matter where in the world you choose to live. In a life-threatening emergency, it could mean being evacuated home or transferred to a country with higher-quality care.

Because medical standards vary widely between countries and regions, comprehensive international health insurance tailored to your location and travel needs is critical.

Choosing the right plan, however, can be overwhelming. With so many policies, complex wording, unfamiliar terms, and hidden exclusions, it’s easy to feel lost. That’s why getting advice from specialists who understand the global insurance landscape makes all the difference.

Our Impartial Advice Depends on Several Factors

Intended country of residence

Pre-existing medical conditions

Benefits vs price

Duration of expatriation

Your health is your most valuable asset – insure it!

Policy Benefits

The foundation of any international health insurance policy is the in-patient benefit. This covers major medical needs—such as serious illnesses, accidents, and surgeries that require hospital stays. These are typically high-cost events, and in-patient cover ensures you won’t be left facing those expenses alone.

Out-patient benefits go a step further. In addition to covering in-patient care, they include treatment that doesn’t require hospitalization—like specialist consultations, diagnostic tests, follow-up care, and ongoing management of chronic conditions.

Choosing whether to include out-patient coverage depends on your lifestyle, health needs, and budget—but understanding the distinction is key to building the right policy.

In-patient (core)

- Private or semi-private rooms

- Inpatient surgeries – including surgeons’ and anesthetists’ fees

- Intensive care

- Cancer treatment

- Transplant services and kidney dialysis

- Diagnostic procedures

- Advanced medical imaging (MRI, CT and PET scans)

- Organ transplants

- Renal failure and dialysis

- Specialist consultations

- Emergency dental

- Emergency evacuation – includes travel costs for an accompanying person, accommodation and compassionate visits

- Medical repatriation – includes repatriation of mortal remains

-

Psychotherapy and psychiatric care

Out-patient

In-patient benefits plus the following:

- Consultations with medical practitioners and specialists

- Out-patient surgeries

- Diagnostic tests

- Dental accidents

- Prescribed medication

- Maintenance of chronic conditions

- Physiotherapy and chiropractic treatment

- Osteopathy and acupuncture

- Podiatry and chiropody

- Chinese traditional medicine and homeopathy

- Dietician

-

Psychotherapy and psychiatric treatment

-

Speech therapy

-

Therapeutic aids and appliances

Add-on benefits

- Maternity cover – Routine and complications of childbirth, 8-12 month wait-periods apply

- Dental care – Preventative, routine, major restorative, orthodontic

- Health and wellness checks – physical exams, pap smears, mammograms, cancer screenings

- Vision – Spectacle lenses and frames, contact lenses and prescription sunglasses

- Accidental death and dismemberment

- Terminal illness cover

- Travel insurance

- Life insurance

- Income protection

- Child immunisations

- Travel vaccinations

Additional features

- Cover at private or public hospitals

- Cover of specific pre-existing conditions

- Easy claim processes, fast refunds and online claims tracking

- No-claims discounts

- Direct billing – provided by some insurers and in some countries

- Pre-approval for high cost treatment

- Lifetime renewable

- Optional 24-month moratorium or full medical underwriting

- Medical advice help lines

- Money back guarantee periods

- Various payment methods and payment frequency options

- Smart phone apps

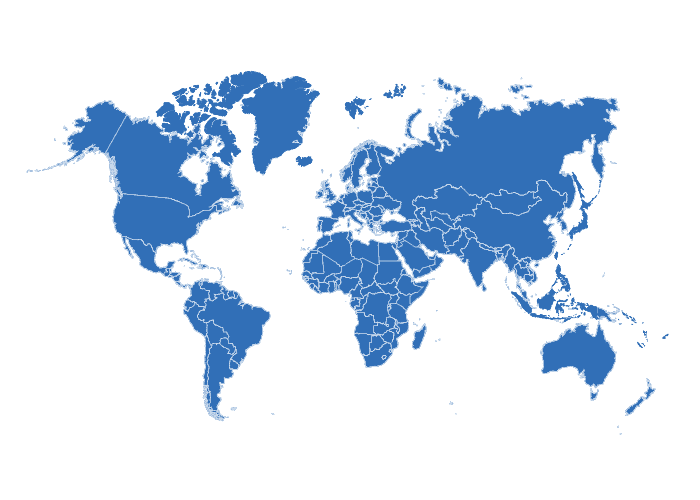

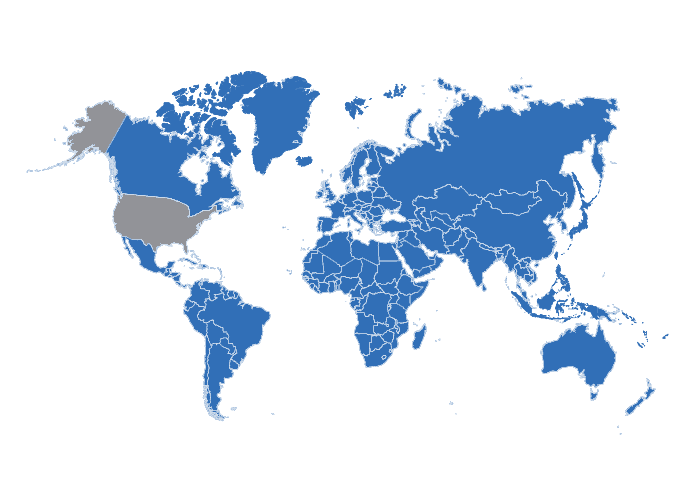

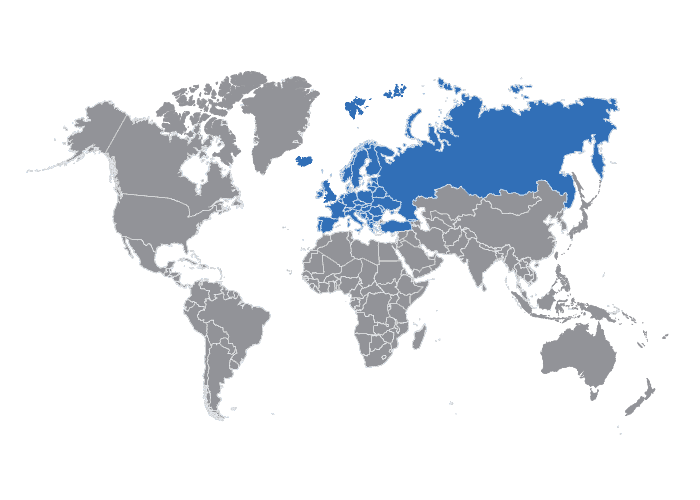

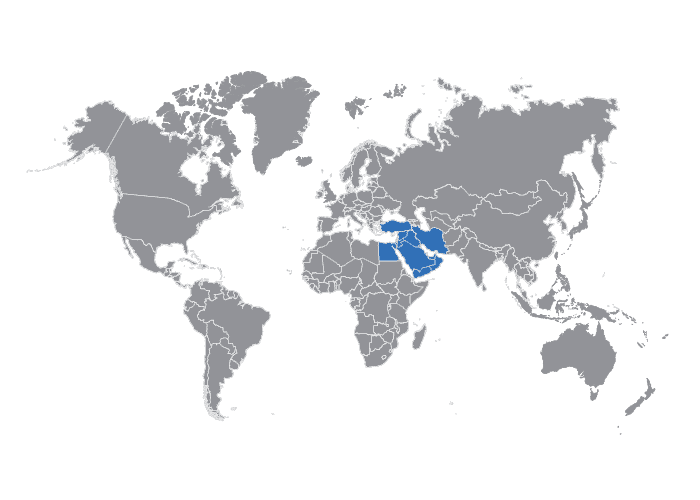

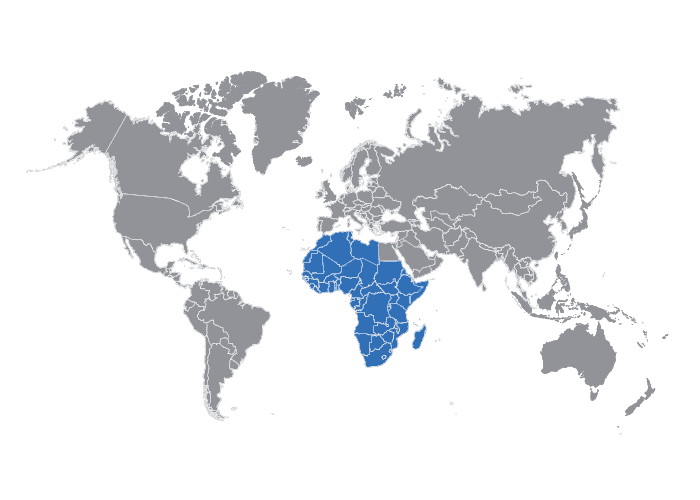

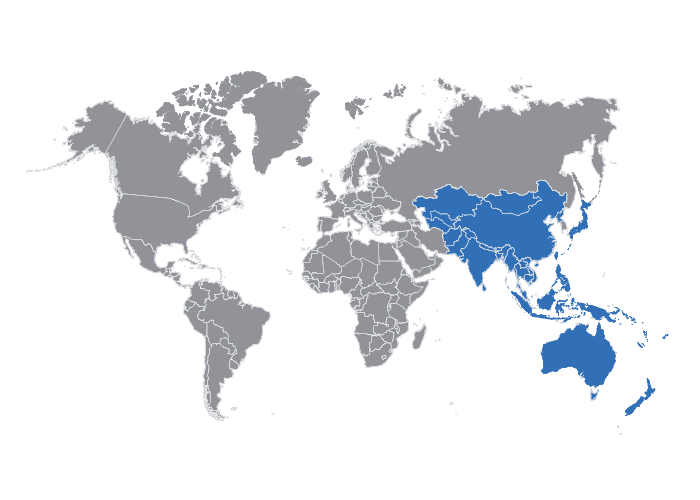

Areas of Cover

For many expatriates, a worldwide (excluding USA) policy is one of the most practical and cost-effective options.

It ensures you’re covered for treatment of illnesses or injuries—no matter where you are—without needing to switch plans every time you relocate.

The USA is often excluded from global policies due to its significantly higher healthcare costs, but coverage can be added if needed. The key is flexibility: one policy that travels with you and adapts to your global lifestyle.

WORLDWIDE

WORLDWIDE (excluding USA)

EUROPE

MIDDLE EAST

AFRICA

ASIA and the PACIFIC

Our 5-Step Process

1. Situation and needs analysis

We ask questions that are quick and easy to answer and help us determine the type of cover you need.

2. Compare options

Insurers are identified that are likely to best meet your requirements. Benefit and premium comparisons are provided.

3. Fine tune

Preferred plan options are fine-tuned. Policy benefits and premium are negotiated on your behalf, saving you time and money.

4. Policy selection

Options are discussed and recommendations provided. We help with and manage the application to ensure it progresses as it should.

5. Implementation

The policy is arranged and documentation delivered. We manage the policy, advocate on your behalf with claims, arrange payment guarantees, medical emergency support and hold insurers to account.